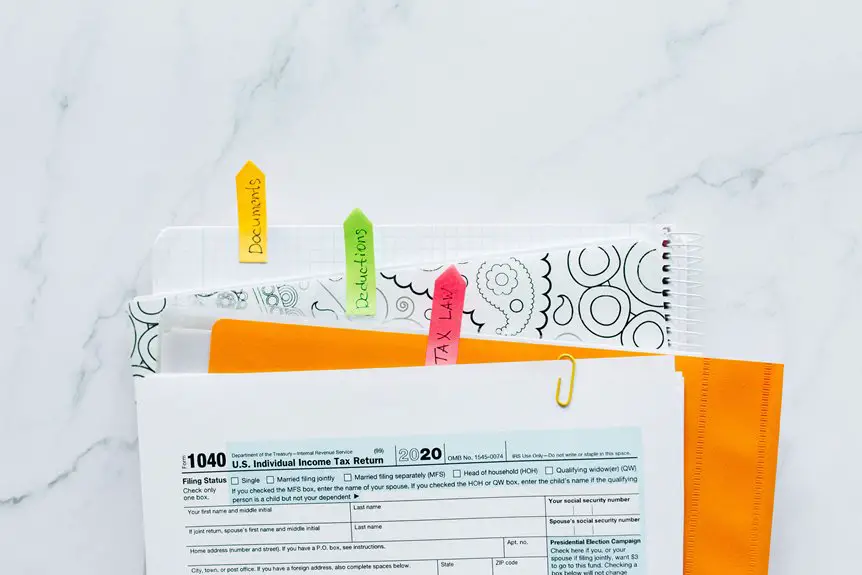

You can legally deduct a range of essential office supplies from your taxes, like paper, pens, printer ink, and notebooks. Items such as folders, sticky notes, and planners also qualify. For tech, computer equipment and software expenses can be deducted too. Don’t forget about furniture or decor that enhances your workspace. Keeping receipts and accurate records is vital for claiming these deductions effectively. Keep exploring to uncover more tax-saving tips!

Key Takeaways

- Office supplies such as paper, pens, and notebooks are fully deductible as business expenses.

- Printer ink, staples, and folders qualify for tax deductions when used for business purposes.

- Planners and calendars that assist in organizing business activities can be deducted.

- Sticky notes and highlighters are also eligible for deduction as office supplies.

- Always keep receipts and maintain accurate records to support your deductions.

Essential Office Supplies for Deduction

When it comes to maximizing your tax deductions, knowing which office supplies you can claim is crucial. You can deduct expenses for items like paper, pens, and notebooks, which are fundamental for running your business.

Don’t forget about printer ink, staples, and folders—these costs add up quickly. If you purchase a planner or calendar to organize your schedule, those expenses are deductible too.

Even things like sticky notes and highlighters qualify. Keep all your receipts and maintain accurate records to guarantee you can substantiate your claims.

Technology and Equipment Write-offs

As you gear up to claim your tax deductions, don’t overlook the significant write-offs available for technology and equipment. You can deduct costs for computers, laptops, printers, and software essential for your business.

If you purchase a new phone or tablet specifically for work, that expense is also deductible. Remember, you can write off both the full cost of items under a certain value and depreciate larger purchases over time.

Keep in mind that only the portion of the expense directly related to your business is deductible, so track your usage. To maximize your deductions, maintain receipts and document how each piece of equipment supports your business operations. This can make a big difference come tax time!

Furniture and Decor Expenses

While you might think of furniture and decor as mere office enhancements, they can also provide valuable tax deductions for your business. When you purchase items like desks, chairs, or shelving units, you can typically deduct these expenses from your taxable income.

This applies to decor items too, such as artwork or plants, which help create a productive work environment.

However, it’s essential to verify these purchases are primarily for business use. Keep all receipts and document how the items contribute to your workspace.

If you buy furniture for both personal and business purposes, you’ll need to prorate the deduction based on the percentage of business use. Doing so can greatly reduce your taxable income.

Home Office Deduction Guidelines

If you’re running a business from home, understanding the home office deduction guidelines is essential for maximizing your tax benefits.

To qualify, your home office must be your principal place of business or a space where you regularly meet clients.

You can choose between the simplified method, which offers a standard deduction of $5 per square foot (up to 300 square feet), or the regular method, where you calculate actual expenses like mortgage interest, utilities, and repairs based on the percentage of your home used for business.

Remember, you can’t deduct expenses for personal use areas.

Staying informed about these guidelines can help you effectively reduce your taxable income while keeping your business compliant with IRS rules.

Record Keeping and Documentation Tips

Keeping accurate records and documentation is essential for maximizing your office supplies tax deductions. Start by organizing receipts and invoices in a dedicated folder, either physical or digital.

Use accounting software or apps to track your purchases; this makes it easier to categorize expenses. Make certain each entry includes the date, amount, and purpose of the expense.

Regularly review your records to confirm everything’s up-to-date and accurate. Don’t forget to keep a log of any business-related discussions or decisions tied to your supplies.

In case of an audit, having thorough documentation will simplify the process and help protect your deductions. By staying organized, you’ll save time and stress come tax season.

Frequently Asked Questions

Can I Deduct Office Supplies Purchased for Personal Use?

Imagine the thrill of a perfectly organized workspace. Unfortunately, you can’t deduct office supplies bought for personal use. Only items essential for your business qualify, so keep your receipts for those necessary purchases!

Are There Limits on the Amount I Can Deduct?

Yes, there are limits on the amount you can deduct. Depending on your business type and expenses, the IRS sets specific caps. It’s essential to keep accurate records to maximize your deductions effectively.

What if I Use Supplies for Both Business and Personal Purposes?

If you’re using supplies for both business and personal purposes, you’ll need to track usage carefully. Only the portion used for business can be deducted, so keep detailed records to support your claims.

Do I Need Receipts for Every Office Supply Purchase?

You don’t need receipts for every office supply purchase, but keeping them is smart. They help you track expenses and provide proof if needed. Organized records make managing your finances and taxes much easier in the long run.

Can I Deduct Shipping Costs for Office Supplies?

Did you know that nearly 75% of small business owners overlook shipping costs? You can deduct those expenses for office supplies if they’re necessary for your business. Keep track of your shipping receipts to maximize savings!